Conservative Javier Milei overcame the Peronist machine, the MSM opposition, and is the new president of Argentina in a blowout result.

It was a blowout!

After finishing second place behind Finance Minister Sergio Massa, Milei got the support from former President Mauricio Macri and his candidate Patricia Bullrich, who finished in third place in the October first round. Since then, Milei jumped ahead in the polls.

Even before the official results of the elections in Argentina, Sergio Massa acknowledged defeat and congratulated his opponent Javier Milei.

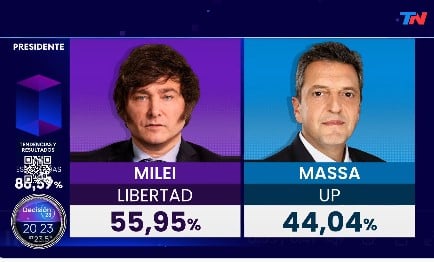

With 87% of ballots counted after Sunday’s election, Milei took 56% of the votes to 44% for Massa of the incumbent left-wing Peronist coalition, according to the official electoral authority.

Reuters reported:

“Argentina elected libertarian outsider Javier Milei as its new president on Sunday, rolling the dice on an outsider with radical views to fix an economy battered by triple-digit inflation, a looming recession and rising poverty. Official results have not been released, but his rival, Peronist Economy Minister Sergio Massa, conceded in a speech. His candidacy was hampered by the country’s worst economic crisis in two decades while he has been at the helm.

Milei is pledging economic shock therapy. His plans include shutting the central bank, ditching the peso, and slashing spending, potentially painful reforms that resonated with voters angry at the economic malaise, but sparked fears of austerity in others.

[…] But Milei’s challenges are enormous. He will have to deal with the empty coffers of the government and central bank, a creaking $44 billion debt program with the International Monetary Fund, inflation nearing 150% and a dizzying array of capital controls.

With many Argentines not fully convinced by either candidate, some had characterized the vote as a choice of the “lesser evil”: fear of Milei’s painful economic medicine versus anger at Massa and his Peronist party for an economic crisis that has left Argentina deeply in debt and unable to tap global credit markets.”

Read more: