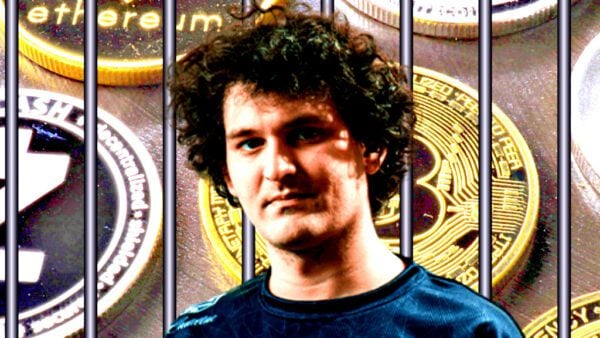

The Sam Bankman-Fried trial reconvenes tomorrow, with the key witness, Caroline Ellison, testifying for the prosecution.

So far, whether a crypto specialist, a judicial professional or a simple lay observer, the conclusions are the same: things are going very badly for the disgraced crypto-bro SBF.

The latest source of trouble for him was the testimony of FTX co-founder Gary Wang, who shared how the Alameda hedge fund was able to access an enormous credit line of customers’ funds at the exchange with his former colleague’s blessing.

CoinDesk reported:

“Prosecutors walked him through the events of the last few years (Alameda owed FTX over $100 million as far back as 2019!) but spent extra time on November 2022, putting a calendar up so the jury (and those of us watching from the back) could keep track of what happened when. FTX and Alameda were troubled for years, with Alameda borrowing billions from FTX over the course of the exchange’s lifetime and requiring an ever-increasing credit line from its sibling company, Wang said. The situation really escalated, however, after ‘some crypto news site’ published a leaked balance sheet, he said.”

One of the reasons for the strong start for the prosecution may be due to the decision to bring the most important witnesses from SBF’s former inner circle right away.

“In one sense, Yedidia was a prosecutor’s dream witness. The former math and engineering major from MIT seemed genuine and at times slightly worried that he might say the wrong thing. His answers were clearly well-rehearsed, if not always accessible to the layperson.”

Gary Wang started off by saying that he committed financial crimes at FTX, and that he committed them at the direction of the defendant, Sam Bankman-Fried.

“Wang testified that Alameda had ‘special privileges’ at FTX that allowed the crypto hedge fund to spend $8 billion of exchange customers’ money, among other things. While he wrote the code allowing that spending, he did so at the direction of Bankman-Fried, he said. It is safe to say just about everybody witnessing this week’s trial so far has the same conclusion: It doesn’t look good for the former FTX CEO.”

The judge has repeatedly scolded the defense for going over information previously asked and answered.

Tomorrow (Tuesday, October 10th), Caroline Ellison is expected to testify. She ran Alameda, the company that took FTX customer funds and somehow lost billions of dollars. She is also Bankman-Fried’s ex-girlfriend and the one he threw under the bus in the New York Times.

“But let’s focus: Alameda and its borrowing of FTX customer funds is the real issue at the heart of this trial, and Ellison’s testimony can clarify to what extent Bankman-Fried may have been aware of and/or directed the financial malfeasance prosecutors allege took place.”

Ellison will be the star witness against Bankman-Fried in a highly-anticipated testimony expected to be pivotal in the criminal case, going deep into the inner workings of FTX and sister hedge fund Alameda Research.

Bloomberg reported:

“Ellison, the former Alameda chief executive officer, is one of the few people in Bankman-Fried’s inner circle whom prosecutors say knows the truth behind the alleged siphoning of billions of dollars in FTX customer funds to the sister trading firm. She pleaded guilty and agreed to cooperate with federal prosecutors after FTX collapsed.

[…] Ellison is likely to discuss a meeting with Alameda employees in November 2022, during which she admitted that her firm used customer funds to repay creditors and that Bankman-Fried authorized it. Prosecutors also have Ellison’s personal diaries which chronicle her serial breakups with Bankman-Fried and the difficulties she had in working with him.”

The prosecutors have said that SBF had wealth, had power and influence – but all of that was built on lies.

“Wang, who pleaded guilty as part of a cooperation deal with prosecutors, went into detail about how Bankman-Fried granted approval of the special privileges Alameda had on FTX, including the ability to withdraw customer funds as early as 2019, eventually giving it a $65 billion credit line. Bankman-Fried’s Nov. 7 tweet stating that FTX was fine was a lie, Wang said.

‘FTX was not fine and assets were not fine’, Wang said.”

According to Wang, Bankman-Fried suggested shutting down Alameda Research in September 2022. Ellison disclosed at that point that Alameda had borrowed $14 billion from FTX and couldn’t afford to repay it, Wang testified.